INCREASE OF STATE CONVEYANCE TAX IN CONNECTICUT EFFECTIVE JULY 1, 2020

If you are a seller and wish not to pay the increase in the conveyance tax, then your sale must be recorded no later than June 30. If you are closing on June 30 but not recording until July 1, then the new state conveyance tax will apply.

What is a real estate conveyance tax? It is a transfer tax usually paid by the seller at the time title to the property is conveyed to the buyer. There are twenty-two (22) types of transactions that are exempt from conveyance taxes, but typical sales for value will require the seller to pay the tax.

In Connecticut conveyance tax must be paid at the closing to both the state and the to the municipality where the property is located. Different municipalities charge different rates. Eighteen (18) municipalities are permitted to charge a higher percentage than the standard rate of .25% of the purchase price.

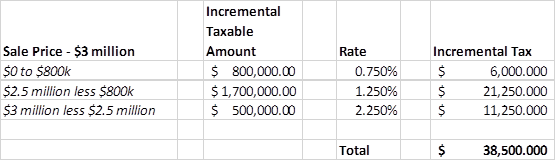

Effective, July 1, 2020 there will be three (3) tiers for the rate payable to the State of Connecticut:

$800,000 or less: 0.75%

Any portion that exceeds $800,000 up to $2,500,000: 1.25%

Any portion that exceeds $2,500,000: 2.25%

For example, if you sell your home for $800,000, you will pay the state a conveyance tax of $6,000. However, if you sell your home for $3,000,000, the new tiered tax rate would apply to the sale. After July 1st the state tax would be $38,500 as calculated in the chart below.

CACACE, TUSCH & SANTAGATA is here to answer any questions you may have regarding any and all real estate issues. Contact us at (203) 327-2000.